Acquisitions

Build a single-family rental portfolio that outperforms

Acquisition strategies

Portfolio acquisitions with a mixture of ‘core’ & ‘value add’ strategies.

Core

- Major markets and specific neighborhoods

- Focus on (1) risk vs. return (2) underlying supply & demand (3) future performance projections (4) employment trends & population growth

- Stable cash flow and returns with limited capital expenditures

Value add

- Emerging secondary markets/neighborhoods and undervalued properties

- Focus on (1) lower risk profile (2) significant growth potential (3) market signals & trends

- Higher returns through capital expenditures

Portfolio types

We help institutions build single-family rental portfolios that outperform. Our acquisitions team focuses on:

SFR portfolios

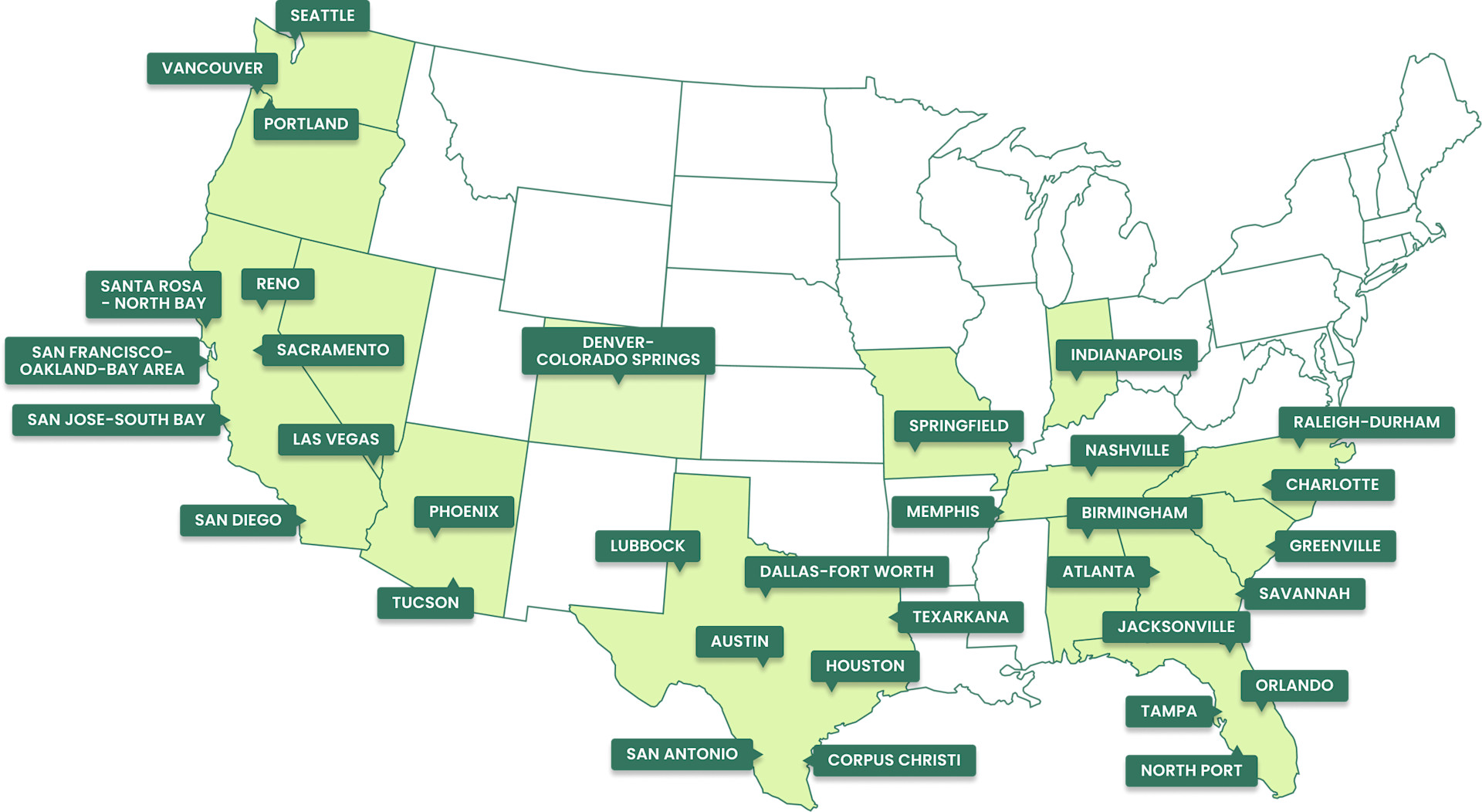

Value add and performing single-family rental portfolios in 30+ markets nationwide.

Build-to-rent

Build-to-rent projects that meet our strict underwriting criteria and timelines. We work with builders and land developers to structure deals at every stage of development and benefit all stakeholders.

Individual/scattered site properties

Individual properties that match an institutional buy box from MLS and alternative channels.

Built for scale in 30+ markets... and growing.

Who we serve

Asset managers & funds

We acquire single-family rentals on behalf of funds, asset managers, family offices, or other institutions looking to purchase SFR assets that deliver maximum returns and outperform competitors, all while mitigating risk.

Builders & developers

We are actively seeking to acquire property from local, regional, and national builders and developers interested in selling single-family rentals. We specialize in SFR portfolio acquisitions, whether build-to-rent communities, individual or scattered site projects, or entire SFR portfolios.

News and insights

Contact us

As an established institutional-grade investment partner, Mynd is able to offer our services a la carte or as part of an all-in-one package. Get in touch for recommendations & guidance to optimize your portfolio.